Remixing AngelList, PitchBook, & the Ivy League

A philanthropy officer looks at higher ed entrepreneurship from another angle.

Dartmouth Hall, Dartmouth College, Hanover, NH

Originally posted on Medium.com 11.5.16

Recently, my team at Dartmouth West helped out with the 2016 Dartmouth Entrepreneurs Forum in SF. The Forum is organized by alumnus Jeff Crowe of Norwest Venture Partners, and this year we welcomed nearly 500 grads. Our team is charged with engaging and building support among west coast grads, and it was inspiring to see the deep ties that bind this community together.

Dartmouth isn’t immediately associated with Silicon Valley, tech, entrepreneurship, etc. — yet it’s clear that innovators are an important part of the alumni community, and that good ecosystem knowledge helps us add value to their relationships with the College. We also know that:

Dartmouth ranks among the nation’s top producers of VC-backed founders, according to PitchBook Data’s 2016–2017 Universities Report, which covers the last decade. The past two leaders of the National Venture Capital Association, Scott Sandell (NEA) and Jon Callaghan (TrueVentures), are alums. Sandell is also one of five Dartmouth alums, along with Crowe, Bryan Roberts, Hurst Lin, and Eric Paley on the 2016 Forbes Midas List. This year, the Thayer School of Engineering became the first national research institution to graduate a class of mostly women engineers. They’re attributes that would make any college proud.

Now, Dartmouth is pretty small. It’s far from Sand Hill. And as helpful as I’ve found the many different entrepreneurship rankings out there to be, most don’t give me a sense of proportionality by controlling for size. So I’ve started using AngelList, PitchBook, and web info to contextualize entrepreneurship in various schools. The “methodology” is rudimentary, but easy to execute, and might provide insights for any school and its peer set.

AngelList + PitchBook

AngelList, founded by Dartmouth alum Naval Ravikant, is a high-profile, high-volume platform in the startup sector. It has also made a concerted effort to map and cultivate alumni networks as the company develops its recruiting product suite, making it a great place to explore a school’s entrepreneurial drive.

Let’s look at the number/proportion of the Ivy League’s Total Living Alumni (TLA) with AngelList profiles. We can consider this a reasonably good sample of alumni in or adjacent to the startup world — a reflection of a school’s entrepreneurial orientation across all the years of its graduates.

Here’s how the Ivy League stacks up when viewed this way, with their corresponding PitchBook ranks:

For some calibration, 6.27% of Carnegie Mellon’s 98,000 TLA are on AngelList. This was the highest I found among the 25 schools on PitchBook’s list that I examined. Stanford has 5.38% of its alumni on AngelList. Data are from AngelList (Oct 2016) and self-reported TLA estimates on institutional websites.

Of course, more widespread adoption of AngelList at smaller schools may be partly because there are big pockets of larger universities devoted to scholarship far removed from entrepreneurship. Still, it’s interesting to estimate the extent to which a startup mindset pervades an alumni body.

Perhaps more noteworthy: it’s also a pretty impressive measure of the mindshare AngelList is building among our nation’s college students and alumni.

Current Students on AngelList

Another great AngelList feature is that it sorts current students by graduation year (whether the degree is an undergrad or grad degree). This represents the future, of course. With entrepreneurship on the rise in US colleges, looking at the penetration of AngelList among the student body is a good way to explore which schools might be hidden gems for recruiters, where alumni relations teams should plan to deploy limited resources, etc.

Only Stanford (4.36%) and CMU (3.86%) have a higher percentage of current students, graduate and undergraduate, on AngelList than Dartmouth, among PitchBook’s top 25.

Beyond the Ivy League : 25 PitchBook Schools

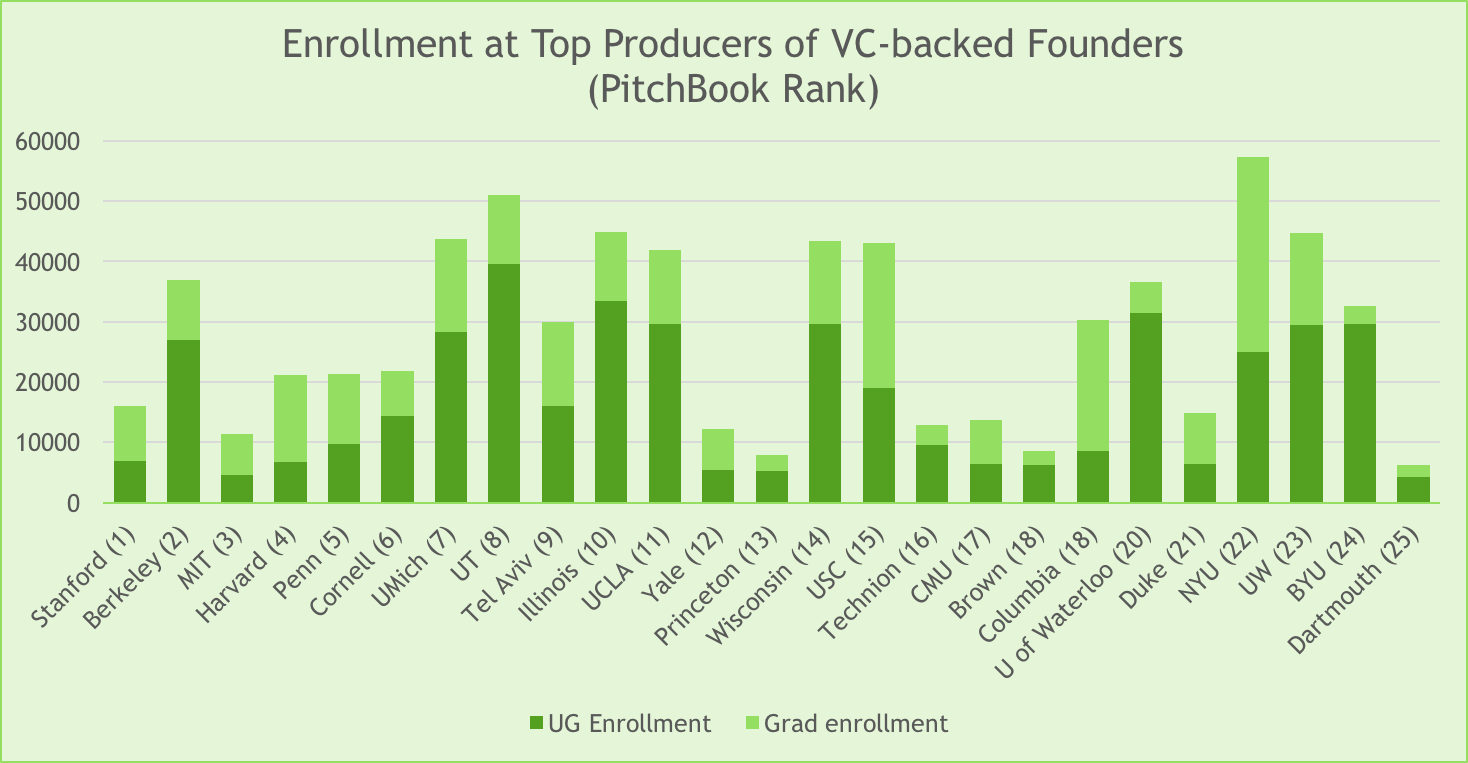

Moving beyond just the Ivy League, here’s a comparison of enrollment in the top 25 universities for VC-backed founders listed in PitchBook’s terrific 2016–2017 Universities Report.

In the report, Dartmouth came in at #25 for undergrad alums and #20 for MBA alums. All eight Ivies made the top 25 for undergrad alums, and all six Ivies that have b-schools made the top 25 for MBA alums.

Over the past ten years, these 25 institutions produced nearly 13,000 venture-backed entrepreneurs from among the ranks of their undergraduate alumni, according to PitchBook, more than any other schools in the world. This chart references enrollment data from each school, and includes graduate populations, to give a broader sense of the student pool.

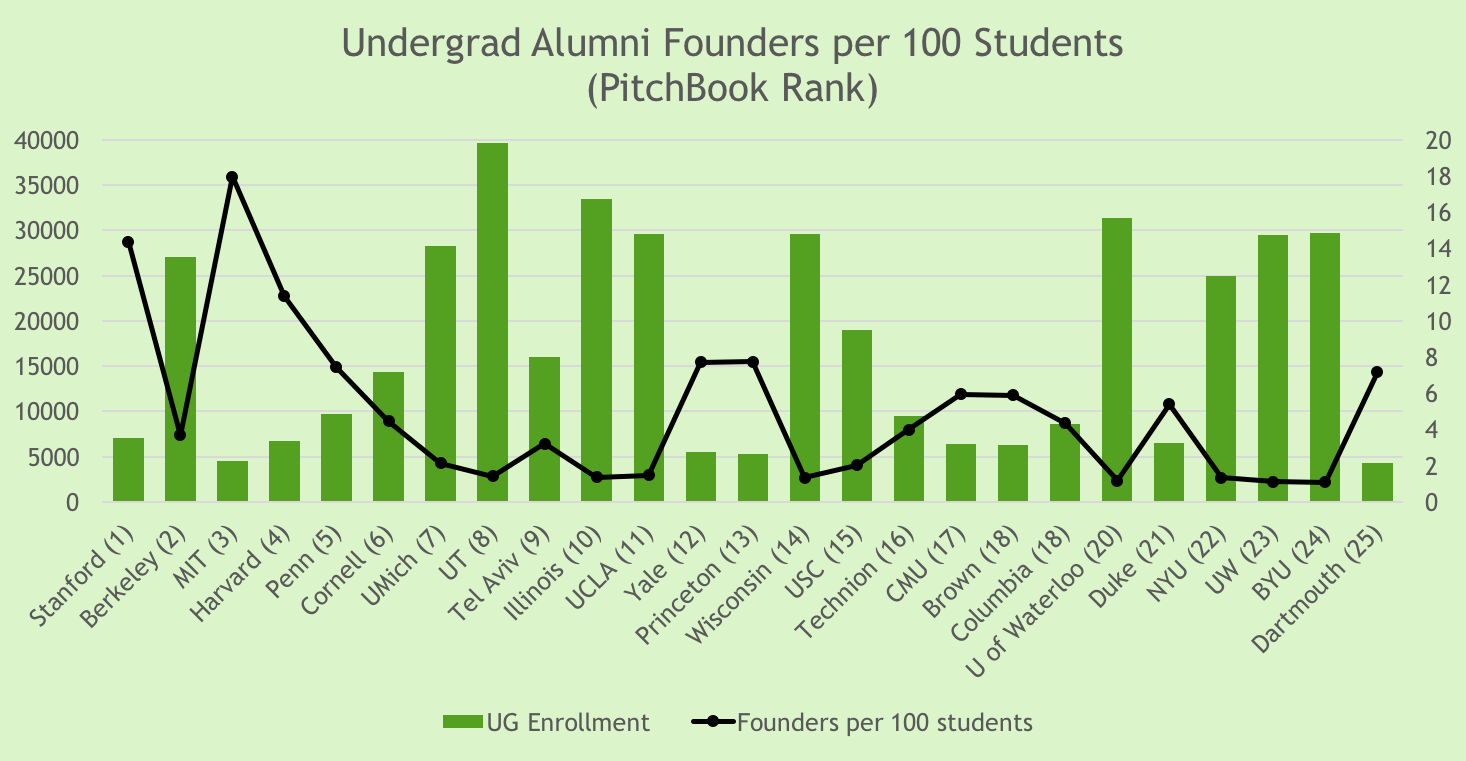

Now imagine that all the undergrads in a given school took the same Intro to Entrepreneurship class, and were grouped into sections of 100 students. Imagine that each section was co-taught by alumni who were themselves VC-backed entrepreneurs.

Which schools would have the most alumni entrepreneurs per section?

Schools like Stanford and MIT are firing on all cylinders, ranking highly for both volume of entrepreneurs, and for relative frequency among the alumni population. This chart takes into account only undergraduate alumni founders, mapped only against undergraduate populations.

At MIT, each section of this theoretical Intro to Entrepreneurship class would have 18 co-teachers or TA’s who were alumni entrepreneurs. Brigham Young University students would have only 1 alumni entrepreneur per section.

Small schools clusters near the top of this slice of the data, while the large schools predictably fall toward the lower end. Notably, schools like Stanford and MIT rank highly for both volume of entrepreneurs and for relative frequency among the alumni pool.

Obviously, more sophisticated analysis could be done — plus there’s plenty of debate about what it means to be a good school for entrepreneurship, and how you measure that; I’m not saying BYU isn’t a great school for future founders! There’s also debate about how entrepreneurship best supports the university’s core mission to educate and create knowledge. In studying entrepreneurship education, the Kauffman Foundation acknowledges that “the university’s first and foremost job is to teach not what to do or even what to think, but how to think,” and explores the interplay between academia and entrepreneurship.

Explore --> How to Find Your Alumni Entrepreneurs

Nonetheless, remixing data like this helps an institution share a more nuanced story about its role in building the future. It’s a step toward better understanding the opportunity inherent in its ecosystem — for engaging alumni, for enriching the academic experience, for increasing the innovation pipeline, and for downstream philanthropy.

“Remixing data like this helps an institution share a more nuanced story about its role in building the future. It’s a step toward better understanding the opportunity inherent in its ecosystem — for engaging alumni, for enriching the academic experience, for increasing the innovation pipeline, and for downstream philanthropy.”